Contact Us : 800.874.5346 International: +1 352.375.0772

You’ve selected your state board, applied for the CPA Exam, and paid all of your fees. Now you’re ready to schedule your exam. This can feel like a very daunting step. After all, you are setting a deadline for your studies. But scheduling the CPA Exam doesn’t have to be overwhelming.

We’ll walk you through how to schedule your CPA Exams and give you some tips on selecting your testing center and exam date.

The CPA Exam is offered for the majority of the year, which means you’re free to select a date that works best for you. There are two tactics most candidates employ when scheduling their exams.

After receiving an approved Notice to Schedule (NTS), some candidates schedule their exams immediately. This option has it’s own pros and cons.

Pros

Cons

Waiting to schedule your exam until you are prepared for the exam also offers unique pros and cons.

Pros

Cons

You have a rolling 30-month period to pass four parts of the CPA Exam.

You can choose a moderate or aggressive study plan to pass four parts within a year, or even 6 months, but you need to ensure that you’ll pass all sections in 30 months. If you do not pass within 30 months, you’ll start to lose credit for passed sections.

Note: NASBA updated the Uniform Accountancy Act (UAA) Model Rules from 18 months to 30 months in order to provide CPA candidates with more choices when it comes to their study schedules. This comes at a time that is especially important since CPA Evolution has added three more sections to the CPA exam.

We suggest you study first and schedule once you feel prepared. Specifically, wait until you’ve completed about 80% of your study plan and then schedule your CPA Exam. This is a good mix of the two that ensures you will waste as little time as possible. Creating a study plan will be key to helping you plan your studies.

Once you have established your study plan, use it to pick a few potential testing dates for each section. Having multiple dates in mind before you begin to schedule the exam allows you to easily adjust if your preferred testing date is unavailable.

The AICPA, NASBA and Prometric have made Continuous Testing possible for core sections of the CPA exam. This means that candidates can sit for their exam year-round and no longer need to worry about exam windows. For Discipline sections, there are specific testing windows. If a candidate is unsuccessful on the exam, they only need to wait until they receive their score before registering to retake the exam again and receiving a new NTS.

You are not required to take four parts of the CPA Exam at the same time. However, you can schedule multiple sections of the exam at any time and even take multiple parts of the exam on the same day. Gleim recommends you take one exam section at a time to help you focus on passing each section. If travel or other constraints force you to take multiple exams on the same day, you will need to adjust your study plan accordingly.

If you do schedule multiple parts of the CPA Exam on the same day, be sure the testing times do not overlap. The Prometric online scheduler will not warn you if they do.

Yes, there is a best time to take the CPA Exam! CPA Exam pass rates are up to 10% higher in the second and third quarters of each year. Learn more about the CPA Exam Golden Window.

For most candidates, selecting a testing center is easy. Prometric has thousands of testing centers, and they are located in every U.S. state and in many countries internationally. You do not need to sit for the CPA Exam in the state you’re applying to, though some states may require you sit for the exam in the U.S.

You do not need to select a testing center before you choose your testing dates. If you need to pass by a particular date, start by selecting your testing date and find a center that matches your needs.

Finding a nearby testing center is simple with Prometric’s search function.

Steps to select a testing center:

Most states participate in the international administration of the CPA Exam. This means you can use one of the Prometric testing centers in the following nations to take the CPA Exam:

England, Scotland, Ireland, Germany, Japan, Brazil, Bahrain, Kuwait, Lebanon, The United Arab Emirates, and India.

Always confirm with your state board prior to scheduling your exam at an international testing center. Learn more about choosing a state board for international candidates.

Once you’ve selected your testing center and have a list of preferred testing dates, it’s time to schedule your exam(s) with Prometric.

You will need your NTS in front of you to schedule the CPA Exam.

The sooner you schedule your exam appointment the better the odds that you’ll get your first choice of date, time, and location. We suggest you schedule your exam once you have completed 80% of your study plan.

Recently, Prometric updated the scheduling tools on for the CPA Exam. We are working on updating the scheduling steps outlined on this page to reflect these new changes.

In the meantime, visit Prometric’s new scheduling website.

The best way to schedule your exam is through the Prometric website. While you can also call Prometric to schedule your exam, the website provides 24-hour access and instant confirmation of your appointment.

Follow these steps to schedule your exam online:

No testing day performs statistically better than any others, but weekends are always going to fill up faster than weekdays. We recommend you either schedule the CPA Exam on a non-workday or take the day off from work. This keeps you from carrying work-related stress with you into the testing center.

You can also call the Prometric Candidate Services Call Center to schedule your exam: 1-800-580-9648. The Prometric call center is open Monday-Friday from 8 a.m. to 8 p.m. eastern time.

You will need to make a separate appointment for each section of the exam you are scheduling. You are not required to make all appointments in one call.

The best time to take the CPA Exam is when you’re going to be most alert. If you’re a morning person, schedule for the morning. If the afternoon is your prime study time, taking the CPA Exam then will ensure you’re not distracted by fatigue.

If you schedule the CPA Exam for the afternoon, stay in a controlled environment leading up to the exam. Don’t risk a bad work interaction, an argument, or even frustrating traffic when you’re preparing mentally to sit for the CPA Exam.

If you need to change or cancel a testing appointment after you’ve scheduled it, you must notify Prometric.

You may reschedule or cancel an appointment by using Prometric’s website or calling the Candidate Services Call Center. You will need the confirmation number from your original appointment in order to reschedule or cancel your appointment. Make sure you follow all instructions. If you don’t, your reschedule or cancel request may not go through.

You may be required to pay a rescheduling fee or even forfeit your examination fee depending on when you notify Prometric. There is no fee if you contact Prometric to reschedule 30 or more days in advance. With 6-29 days’ notice, the fee to reschedule is $35. It is $83.76 with 5 or fewer days’ notice. As long as your rescheduled date is still within the valid period given on your Notice to Schedule (NTS), you will not need to repay the application and examination fees.

Find out more about rescheduling fees on our costs to reschedule your CPA Exam resource page.

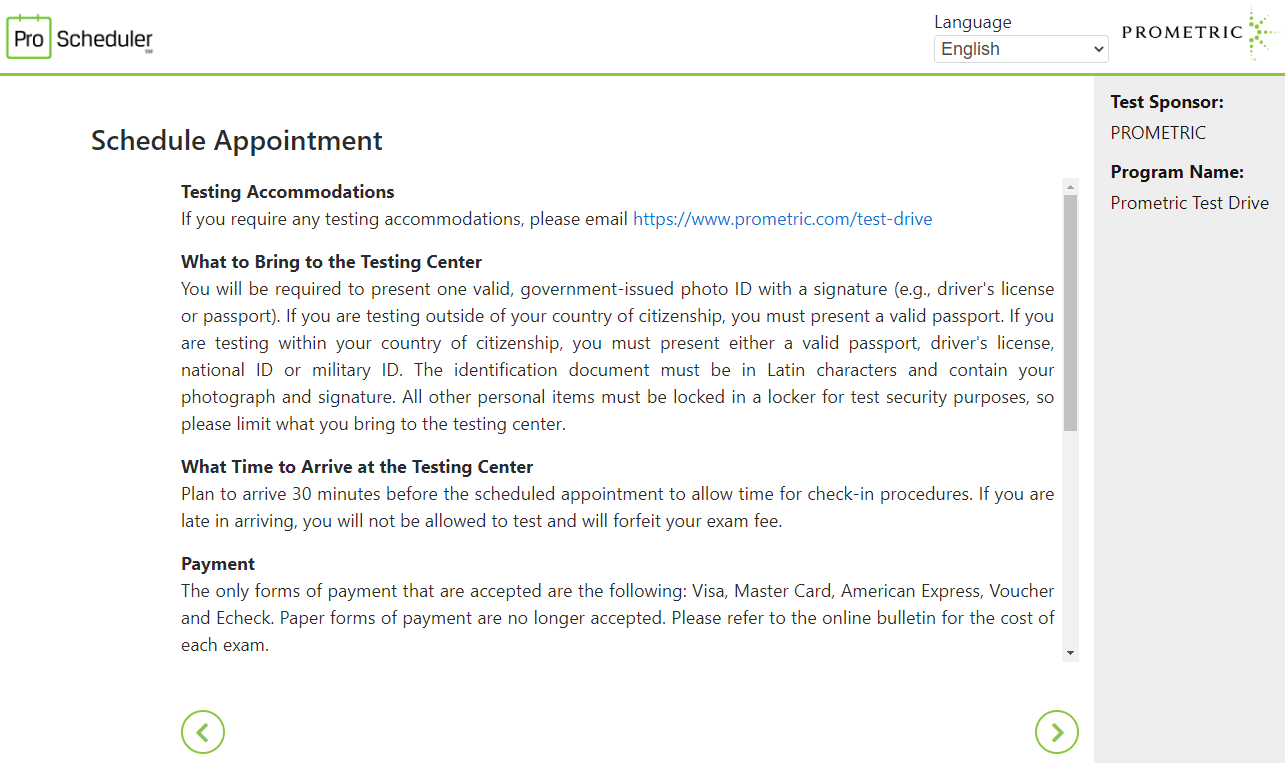

Prometric believes that “familiarizing yourself with the look and feel of the computer-based testing environment in advance of your exam will minimize pre-test mistakes,” and Gleim agrees! It’s a great idea to take the Prometric Test Drive before you sit for the actual CPA Exam.

The Prometric Test Drive is a $30 service that involves a 30-minute, real-world practice run of the test center experience at your chosen testing site.

The Gleim CPA Review System includes an exam rehearsal that will completely prepare you for the look, feel, and interface of the CPA Exam. However, it does not replace the Prometric Test Drive.

Physically visiting your testing center will provide a ton of peace of mind on exam day. During your test drive, you’ll save exam-day stress by:

To schedule a Prometric Test Drive, you’ll follow the same steps as scheduling an exam.

How to schedule a Prometric Test Drive:

During your test drive, you’ll go through all of the testing procedures that you will have to undergo on exam day. These procedures include the following:

While you won’t receive real CPA Exam questions on the sample test you take during this time, the service gets you used to the logistics of your testing appointment.

The test drive also gives you the chance to discover the parking situation, the location of the test center, and the amount of time required to drive there. Taking these steps ahead of time eliminates unnecessary stress on exam day and better prepares you for CPA Exam success.

Prometric offers a wide variety of testing accommodations for qualified people. These include everything from adjustable desks for back injuries to text-to-speech software for the hearing impaired. A listing of the types of accommodations all Prometric centers can provide can be found on Prometric’s testing accommodations PDF.

Candidates who need special testing accommodations have a few additional considerations when scheduling their CPA Exam.

Many candidates agonize over which CPA Exam section to take first. It’s a personal choice, but there are four common ways people choose:

We cover the pros and cons and offer our guidance for each below.

When it comes to picking which section of the CPA Exam to take first, our advice is to take the section that appeals to you most or that is the most familiar to you. Look over what each section tests and ask yourself what topics you’re most comfortable with based on recent classes or work experience.

Learn all about it in our guides to the CPA Exam sections.

The CPA exam will consist of three required core section exams, and three discipline section exams, where you will have to choose one discipline to study and pass.

Pros

Cons

Whether it’s because you’ve recently taken a course on financial planning or currently work as a tax preparer, some sections of the CPA Exam will be easier for you than other sections. Beginning your studies with the material you know best is a common way to schedule your CPA Exam.

Pros

More likely to pass on the first try

Less time spent studying for your first section

Build confidence in your abilities and knowledge

If your score expires, you’ll likely only need to retake an easy section

Cons

Delays taking more difficult exams

After passing an easy exam, you may not study enough for harder exams

Starts your 30-month timer before you’ve passed your hardest section

This really depends on your history with the topics, but AUD is consistently ranked as the easiest sections of the CPA Exam by most candidates. Your answer might be different, so we suggest you look over the content covered by each part and decide for yourself.

Find out more about how hard the CPA Exam is on our resource page.

Candidates who take the hardest CPA section first can enjoy a more downhill exam journey. The hardest section will always depend on your personal experiences, but the CPA Exam pass rates can provide some guidance.

Pros

Allows ample study time to be invested without any risk of previously passed sections expiring

Other sections will be easier to prepare for once you’ve overcome the hardest section

Build confidence in your abilities and knowledge

Cons

If you fail to pass on your first try, it can be very discouraging

If you do not pass your remaining three parts within 30 months of passing the first, you’ll have a difficult section to retake

Difficult to build good study habits while studying demanding materials

The FAR section of the CPA Exam is usually considered the most difficult. But every candidate is going to bring his or her own background and skills to the exam, so each candidate’s experience will be different.

Find out more about how hard the CPA Exam is on our resource page.

When the CPA Exam is about to change, it can be tempting to rush and take the sections that are about to change the most, but this is rarely a good idea (unless you are already well-prepared for that section). However, taking the section that will change the least is often a good idea.

Be sure to consider the other methods along with this one.

Pros

If anything delays your exam and you don’t pass the exam before it changes, you won’t need to restudy much material.

If you do not pass four parts within 30 months, more of your studied material will still be relevant to the exam.

Many CPA Exam review providers recommend you hurry to pass an exam when you know it’s going to change significantly. The thinking behind this is that CPA Exam changes bring about uncertainty, which may affect your score.

But the AICPA tests new questions for the CPA Exam on the real exam (as ungraded questions), so you can be confident that scores won’t change wildly after the CPA Exam changes. Focus on passing the first time you sit for the exam, and do not get caught up in the panic before the exam changes.

Additionally, remember that the exam changes for a reason: to better reflect the current experience of CPAs in the field. Why rush to learn concepts that you may not use in your career?

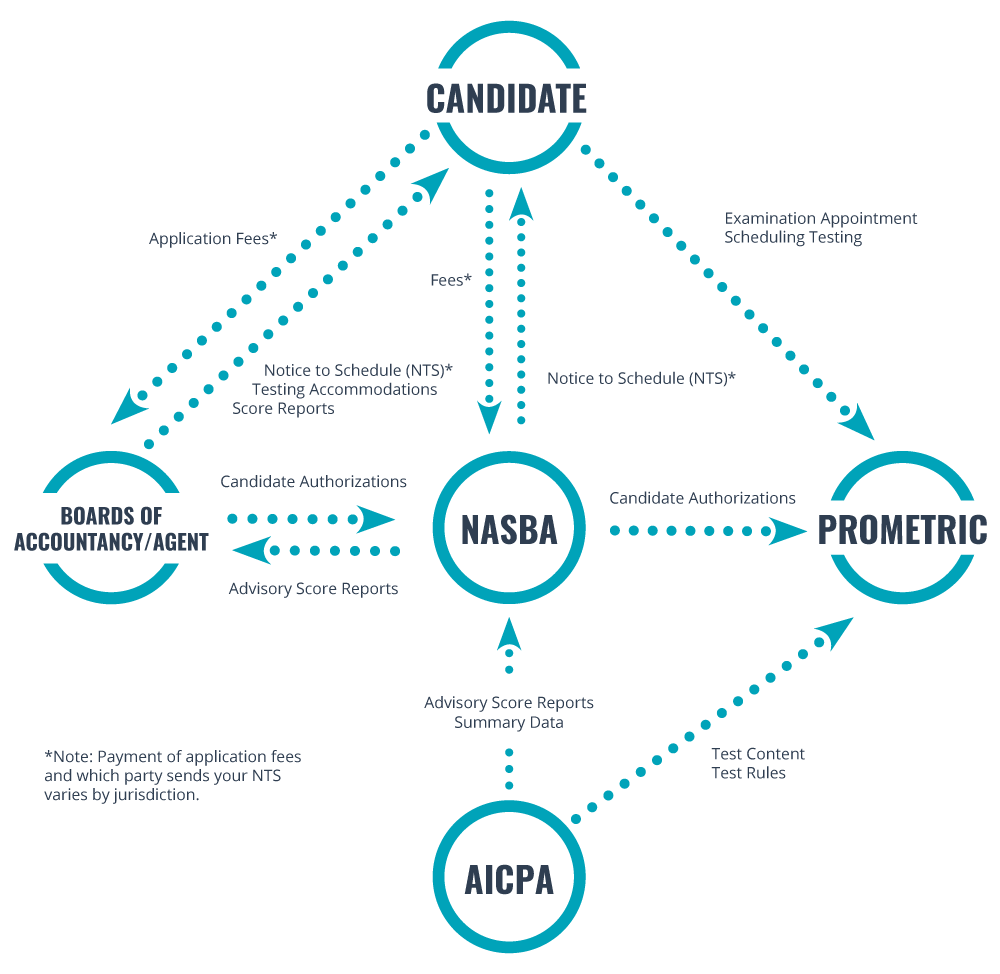

During your application process, you’ll interact with several CPA Exam partners. You’ll be sending information, fees, and transcripts as needed to these organizations.

The graphic below can give you a sense of the relationships and interactions you’ll likely have when you apply and sit for the CPA Exam.

These organizations collaborate to put together the Uniform CPA Examination Candidate Bulletin, an excellent resource when applying for the CPA Exam.

As CPA licenses are issued at the state level, the state boards approve your application for licensure. They may also process applications, collect fees, and provide score releases. In addition, all testing accommodations must be approved by your state board of accountancy.

NASBA is the national group that acts as a consolidator for various state boards and assists those organizations. State boards work with NASBA to grant candidate authorizations and share advisory score reports. NASBA issues your Notice to Schedule (NTS) and assists the state boards in the CPA Exam application process. NASBA also shares candidate authorizations with Prometric and receives advisory score reports summary data from the AICPA.

In addition to other responsibilities, the AICPA creates the CPA Exam. It provides the test content and rules to Prometric and gives the advisory score reports summary data to NASBA.

Prometric is the company that administers the CPA Exam.