Contact Us : 800.874.5346 International: +1 352.375.0772

The Financial Accounting and Reporting (FAR) CPA Exam section historically has received the lowest pass rates of any CPA Exam section. In fact, CPA candidates often refer to FAR as the most difficult of the CPA Exam. FAR tests your knowledge of the financial accounting standards. In this four-hour exam, you are expected to prove that you have the knowledge and skills that a newly licensed CPA must demonstrate in the financial accounting and reporting frameworks used by business, not-for-profit, and state and local government entities.

To pass FAR, you’ll need to understand the technical financial accounting standards and get comfortable performing accounting math under a time limit. That means really knowing the material and doing a lot of practice quizzes. If that sounds like a challenge, you can appreciate why FAR has the lowest CPA pass rate.

The rest of this guide will equip you with all of the information you need to prepare for the FAR section of the CPA Exam. But if you’re already studying, check out some of our free webinars and videos or make use of our free FAR questions.

Contents

All about the Financial Accounting and Reporting (FAR) CPA Exam Section

Why does the AICPA include pre-test questions on the FAR exam?

• What is a CPA passing score?

• Can I receive partial credit on Task-Based Simulations (TBSs)?

• When do new pronouncements appear on the CPA Exam?

FAR CPA Exam time management

How do I prepare for FAR?

• What is the best way to study for the FAR CPA Exam section?

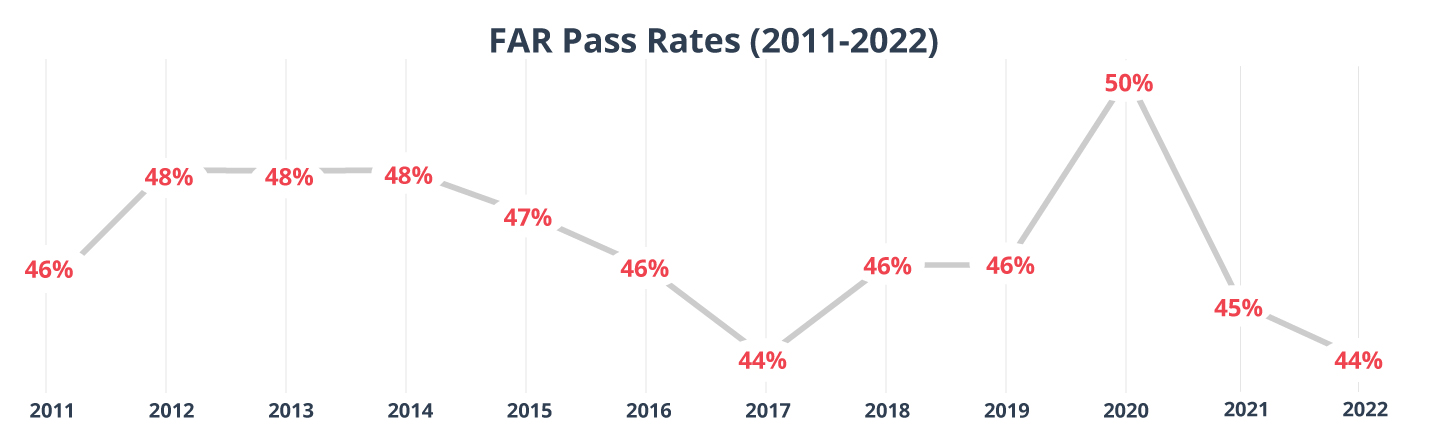

In recent years, FAR has had the lowest pass rates of all four CPA Exam sections. Pass rates rose notably to almost 50% in 2020, but leveled back out to 45% in 2021. We’re seeing this trend continue with FAR’s 2022 pass rate starting out at 45%. It’s likely that FAR’s pass rate will remain in the mid-40s throughout the remainder of 2022.

For more information about how the FAR CPA Exam section has evolved over time and what’s new this year, visit our CPA Exam Changes page.

Just because the pass rates are lower than other sections doesn’t mean you should write off the FAR section as impossible. The purpose of the CPA Exam is to ensure that candidates who pass with the lowest possible score are capable of performing the duties of a CPA. Everyone who passes should reflect positively on the profession. That’s the reason CPAs earn 10-15% higher salaries on average than their non-certified peers.

Take a more detailed look at CPA Exam pass rates, including seasonal trends.

The FAR CPA Exam section consists of five testlets: two testlets of multiple-choice questions (MCQs) and three testlets of Task-Based Simulations (TBSs). The MCQ testlets of FAR account for 50% of your CPA Exam score, and the TBS testlets account for the other 50%.

FAR Format Breakdown

Testlet 1 33 MCQs

Testlet 2 33 MCQs

Total MCQs: 66 | Scoring: 50%

Testlet 3 2 TBSs

Testlet 4 3 TBSs

Testlet 5 3 TBSs

Total TBSs: 8 | Scoring: 50%

Testing Time 4 hours + 15 min break

FAR Format Breakdown Starting January 2024

Testlet 1 25 MCQs

Testlet 2 25 MCQs

Total MCQs: 50 | Scoring: 50%

Testlet 3 2 TBSs

Testlet 4 3 TBSs

Testlet 5 2 TBSs

Total TBSs: 7 | Scoring: 50%

Testing Time 4 hours + 15 min break

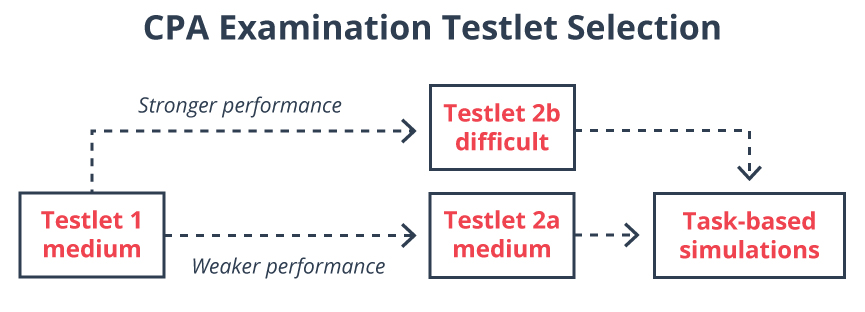

The AICPA prescribes two levels of difficulty to MCQ testletsOpens in new window: medium and difficult. These indicate the average difficulty of questions within the testlet. Like the other CPA Exam sections, the second MCQ testlet adapts to your performance on the first.

According to the AICPA, there is no advantage or disadvantage of receiving harder or easier questions because the exam takes question difficulty into account during grading. In short, harder questions are worth more points.

The difficulty of the first MCQ testlet you receive is medium. The difficulty of the next testlet is determined by your performance on the first.

Candidates will not know which testlet they receive on their exam, nor will they know which difficulty is prescribed to each question. Candidates should answer each question to the best of their ability, regardless of the perceived difficulty.

If you perform well on the first testlet, you will receive a difficult testlet. If you do not perform well on the first testlet, you will receive another medium testlet.

Because the difficulty assigned to each testlet is based on the average difficulty of the MCQs, expect a few questions to give you pause, even in a medium-difficulty testlet. Be ready to flag any confusing questions that stump you and come back to them once you’ve finished the rest of the testlet.

Your performance on the MCQ testlets does not impact the difficulty level of your TBS testlets. TBS testlets are pre-selected, which means their difficulty does not change based on your performance.

Most FAR testlets include operational and pre-test questions. Operational questions count toward your total exam score, and pre-test questions do not. That said, the questions are indistinguishable from one another, so don’t waste any valuable testing time trying to decide whether you can afford to skip a question!

FAR Question Categories | ||

Question Type | Operational | Pre-test |

MCQs | 54 | 12 |

| TBSs | 7 | 1 |

The AICPA looks to continuously evolve and improve the CPA Exam. Pre-test questions are potential future exam questions the AICPA is trying out by inserting them among real exam questions. This lets it study how suitable the questions will be for future use.

The AICPA already knows what topics the operational questions test and how difficult they are, so it is able to analyze candidate performance on pretest questions with the operational questions serving as a sort of control. While no one likes to be a guinea pig for experiments—especially on an exam this difficult—keep in mind that your scores on these questions will not count.

The pre-test questions that meet the AICPA’s standards are included as operational questions on later iterations of the exam. This pre-test period is also used to assign a difficulty level to questions for grading purposes, and questions continue to undergo statistical analysis based on the live exam.

THE ![]() SOLUTION

SOLUTION

Pre-test questions may be perceived as more difficult than operational questions, but because the two types are indistinguishable, it’s best to answer all questions to the best of your ability. If it helps, whenever you encounter a really difficult question and aren’t sure of your answer, just tell yourself it’s probably a pre-test question, make an educated guess, and keep moving!

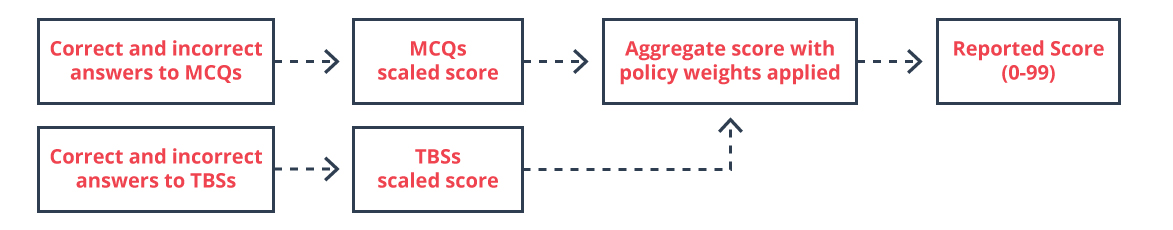

Computers grade all CPA MCQ and TBS testlets. Your score is scaled according to the difficulty of the MCQs you answered correctly and the credit you receive on the TBSs. (See more on how the CPA Exam is scored.)

A CPA passing score is 75 points or higher. That’s 75 points, which does not necessarily mean you need to answer 75% of questions correctly.

Difficult questions are worth more points, so a strong performance on the first MCQ testlet can give you an opportunity to earn even more points in the second MCQ testlet. Difficult questions are also more time-consuming, so you’ll need to practice a time-management strategy to optimize your score.

The CPA Exam is not curved in the same way as other exams you might have come across in your accounting studies. Instead of adjusting your score based on how your cohort does, the AICPA uses question weights. These weights are assigned based on how candidates fared with the questions on previous exams. So your score is impacted by the performance of past test takers, not current ones.

It’s worth repeating here that your score is not a percent. You don’t have to get 75% of the questions right—you just need a score of 75. If you think you’re borderline passing, you’re probably fine. A 65% may in fact be 75 points after it’s scaled.

Yes, you can receive partial credit on TBSs! Never leave any part of a question blank, and always double-check to make sure you’ve answered all parts of a question. No two TBSs are the same. They can have wildly different formatting and require you to input your answer in different ways, so stay sharp.

For more information on how your FAR section will be scored, please check out our guide to CPA Exam scoring. You can also see the AICPA’s FAQsOpens in new window or contact one of our Personal Counselors. We’re always here to help!

THE ![]() SOLUTION

SOLUTION

Gleim knows that the CPA Exam can be daunting for even the best candidates. That’s why we’ve developed a team of highly-trained professionals to help answer your questions about the CPA Exam and suggest the best methods for studying. Personal Counselors are available by phone and by email for all of our CPA Review System holders.

The AICPA publishes CPA Exam Blueprints that specify exactly what a CPA needs to know, all the way down to specific tasks. Of the four CPA Exam sections, FAR contains the broadest coverage of accounting information.

FAR expects candidates to demonstrate knowledge and skills related to the financial accounting and reporting frameworks used by business entities (public and nonpublic), not-for-profit entities, and state and local government entities. The FAR section tests standards and regulations issued by:

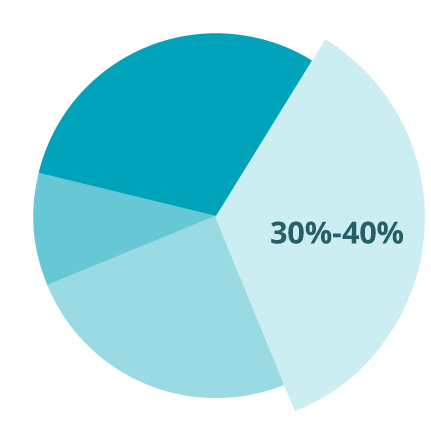

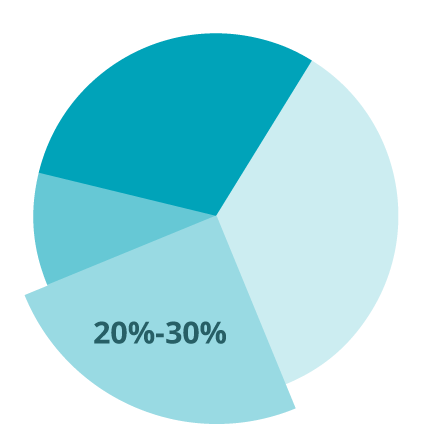

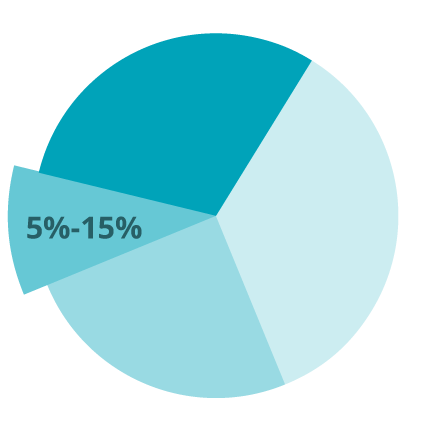

| FAR CPA Exam Content* For a breakdown on the exam contents, click the links below. |

|

|---|---|

| Content | Percentage |

|

Conceptual Framework, Standard-Setting and Financial Reporting |

25-35% |

| 30-40% | |

| 20-30% | |

| 5-15% | |

*NOTE: These Blueprints reflect the changes effective July 1, 2021

It’s good to look over the higher-level concepts to get a broad idea of what you should be taking away from your studies, but the Blueprints aren’t really useful for candidates making a study plan. The Blueprints are incredibly detailed, and if you were to go through them on your own, you’d likely spend just as much time figuring out what to study and how much time to devote to each topic as you would actually preparing for the exam.

Our recommendation is to let a CPA Exam review course provider do the bulk of the work for you. All major providers have teams of experts that pore over each Blueprint update, taking the guesswork out of studying. Learn how to find the right review course for you.

The AICPA calls new material it has identified for future inclusion on the CPA Exam “pronouncements.”

New accounting and auditing pronouncements are eligible to be tested the later of (1) the first calendar quarter beginning after the pronouncement’s earliest mandatory effective date or (2) the first calendar quarter beginning six months after the pronouncement’s issuance date.

Changes in federal laws outside the area of federal taxation are eligible to be tested in the calendar quarter beginning six months after their effective date.

Changes in uniform acts are eligible to be tested in the calendar quarter beginning one year after their adoption by a simple majority of the jurisdictions.

For all other subjects covered by the CPA Exam, changes are eligible to be tested the later of (1) the first calendar quarter beginning after the earliest mandatory effective date or (2) six months after the issuance date.

Once a new pronouncement is testable, questions testing the old pronouncement will be removed.

Gleim CPA Review Courses are automatically updated to reflect the latest testable information.

With a routinely low pass rate (just under 45% in 2021), FAR is considered the most challenging section of the CPA Exam. BEC has traditionally been considered the easiest, and AUD and REG are generally somewhere between the two extremes.

But no section of the CPA Exam is easy. The AICPA defines four levels of skill at which it will test you, so it won’t be enough to study questions and answers—you’ll have to take the time to learn the concepts.

Each skill level builds upon the preceding one. FAR focuses heavily on Application. More than any other section, come to FAR prepared to crunch some numbers. FAR is a difficult exam, but with a proper study strategy and a CPA review provider that can help you master the material, you can pass on your first try.

Pass rates aside, there are some who consider the FAR section of the CPA Exam the easiest of the four because the content best reflects common college accounting coursework. Therefore, current students or recent college grads who have information from their classes still freshly available may want to take FAR first.

CPA candidates who have been out of school a little longer can also benefit from taking the FAR CPA section first. The AICPA requires candidates to pass all four sections of the CPA Exam in a rolling 18-month period. This means that once you pass your first section, you’ll have 18 months to pass the other three. Because the clock doesn’t start ticking until you pass a section, it can be advantageous to pass FAR first, as it often requires more study time than any other section, and none of that extra time would be included in your 18-month window.

Furthermore, the CPA FAR material overlaps with that of the other three sections, so beginning your studies with FAR will give you a head start on your studies for AUD, BEC, and REG.

Despite these advantages, FAR is regarded as the most difficult CPA Exam section by the majority of candidates. You can clear a major hurdle by tackling FAR first, but it’s entirely reasonable to build your confidence and your base of knowledge by starting with another section.

The total testing time for FAR is four hours, the same as the other CPA Exam sections. The five testlets of the FAR CPA Exam section are independent. There are no time limits on the individual testlets, so it is up to you to manage your time appropriately so that you can complete all five testlets before the exam ends.

Based on the total time of the exam and the amount of time needed to complete each testlet, you should plan to spend

MCQs

1.25 minutes each

TBSs

18 minutes each

FAR Time Allocation by Testlet | |||

Teslet | Format | Question Count | Time (in minutes) |

| 1 | MCQ | 33 | 41 |

| 2 | MCQ | 33 | 41 |

| 3 | TBS | 2 | 36 |

| 15-minute break (does not count toward total exam time) | |||

| 4 | TBS | 3 | 54 |

| 5 | TBS | 3 | 54 |

| Extra Time | 14 | ||

| Total | 66 MCQs / 8 TBSs | 240 | |

It will take a good deal of practice to be able to answer questions this quickly, but as you learn the material and complete more sample questions, you’ll build mastery of the topics and your speed will improve.

This system gives you 14 minutes to use at your discretion. You should spend that time reviewing your MCQ and/or TBS answers, but remember, you can’t revisit any previously submitted testlets, so only use the banked time if you need it. That said, make sure to use all the time you have available. There’s no reason to leave the testing center without taking advantage of all the time you have available.

For the past few years, the FAR CPA Exam section pass rates have hovered around 45%, the lowest of any CPA Exam section for the period. Candidates report spending more time studying for FAR than for the other sections, so make a CPA Exam study schedule and put in the time needed to truly understand the topics tested.

Of all the exam sections, FAR covers the widest range of accounting information. Establishing a firm grasp of FAR topics may require up to 10-11 weeks (minimum 6), so allot your time accordingly. Do not skip any material in your CPA review course, especially concepts you find difficult, to finish more quickly. You need to have genuine confidence in order to pass FAR, and building that confidence takes time.

1. Practice rewording information rather than simply reciting it.

A good gauge of your familiarity with FAR topics is your ability to explain them in your own words. If you can do that easily, you’ll know you’ve absorbed and understood the core concepts. To pass the test, the CPA Exam MCQs and TBSs require you to apply the concepts. Memorized words and phrases will not get you far.

2. You’ll want to make sure you’re proficient with journal entries, schedules, and T-accounts.

Most candidates will encounter journal entries throughout the MCQs and TBSs. As you study for FAR, you can practice the relevant skills by creating journal entries for questions even when they’re not required.

It is not uncommon for FAR CPA Exam questions to require the creation of a schedule, such as for amortization. You should practice completing full schedules as you study so you can do it quickly on the exam. Until you’re comfortable, always fill in the entire schedule, even when only a partial one is necessary, so you’ll be ready to tackle schedules on exam day.

While you may not be asked to complete T-accounts for points on the actual exam, you may need to create them in order to visualize more difficult MCQs and TBSs. You should create T-accounts throughout your study quizzes, as it will not only increase your speed on exam day but also further solidify your understanding of complicated concepts.

3. Put in plenty of practice with multiple-choice questions and task-based simulations .

Completing quizzes with multiple-choice questions (MCQs) and task-based simulations (TBSs) is an essential part of FAR preparation. The FAR CPA Exam section features 66 MCQs and 8 TBSs across 5 testlets. Mental fatigue is a danger in FAR more so than for any other section because of the amount of math required. To develop your endurance, quizzes should be a regular part of your review.

Thankfully, the SmartAdapt™ technology of Gleim CPA Review is always ready to lead your studies and give you plenty of opportunities to practice. Each time you begin a new study unit, SmartAdapt presents a quick diagnostic quiz covering the content of the study unit, and this quiz will determine your strengths and weaknesses based on your responses. As you work through the course, SmartAdapt will direct you to review challenging concepts more thoroughly and will continue to quiz you on them until you prove to be acceptably proficient. SmartAdapt works with our acclaimed test bank of CPA Exam questions, and our technology provides detailed feedback on your quiz results so you can stay on top of your progress.

If you’re looking for a start-to-finish CPA Exam walkthrough, check out our free CPA Exam Guide for more information! This free PDF contains our top tips for scheduling, studying, and sitting for the CPA Exam.

Visit our CPA Exam Resource Center to view our latest CPA Salary Report, confirm that you meet CPA Exam requirements, and more.

25-35% Conceptual Framework, Standard-Setting and Financial Reporting

25-35% Conceptual Framework, Standard-Setting and Financial Reporting

30-40% Select Financial Statement Accounts

20-30% Select Transactions

5-15% State and Local Governments