Contact Us : 800.874.5346 International: +1 352.375.0772

There are four sections you must pass to complete the CPA Exam: Auditing & Attestation (AUD), Business Environment & Concepts (BEC), Financial Accounting & Reporting (FAR), and Regulation (REG).

Currently, you must sit for and pass each of these four sections in order to complete the CPA Exam. With the CPA Evolution exam changes going into effect in January 2024, the exam structure will be changing and the BEC exam will no longer be tested. If you’re sitting for the CPA Exam in 2024, you’ll still need to pass a total of four sections: the three remaining Core exams and your choice of one of three Discipline exam sections.

This guide will give you an overview of the CPA Exam sections, including how they will change in 2024, so that you can know what to expect no matter when you’re testing!

The CPA Exam is designed to measure professional competence in auditing, business law, taxation, and accounting. To accomplish this, each section of the CPA Exam covers different areas of accounting that the AICPA defines in its CPA Exam Blueprints Opens in new window.

Here are the major topics tested on of each of the CPA Exam sections:

Ethics, Professional Responsibilities and General Principles…..15-25%

Assessing Risk and Developing a Planned Response…..20-30%

Performing Further Procedures and Obtaining Evidence…..30-40%

Forming Conclusions and Reporting…..15-25%

Conceptual Framework, Standard-Setting and Financial Reporting…..25-35%

Select Financial Statement Accounts…..30-40%

Select Transactions…..20-30%

State and Local Governments…..5-15%

Corporate Governance…..17-27%

Economic Concepts and Analysis…..17-27%

Financial Management…..11-21%

Information Technology…..15-25%

Operations Management…..15-25%

Ethics, Professional Responsibilities and Federal Tax Procedures…..10-20%

Business Law…..10-20%

Federal Taxation of Property Transactions…..12-22%

Federal Taxation of Individuals…..15-25%

Federal Taxation of Entities…..28-38%

Starting January 2024, the CPA Evolution exam changes will go into effect. The topics and content allocation for the Core and Discipline sections are below.

Ethics, Professional Responsibilities and General Principles…..15-25%

Assessing Risk and Developing a Planned Response…..25-35%

Performing Further Procedures and Obtaining Evidence…..30-40%

Forming Conclusions and Reporting…..10-20%

Financial Reporting…..30-40%

Select Balance Sheet Accounts…..30-40%

Select Transactions…..25-35%

Ethics, Professional Responsibilities and Federal Tax Procedures…..10-20%

Business Law…..15-25%

Federal Taxation of Property Transactions…..5-15%

Federal Taxation of Individuals…..22-32%

Federal Taxation of Entities…..23-33%

Business Analysis…..40-50%

Technical Accounting and Reporting…..35-45%

State and Local Governments…..10-20%

Information Systems and Data Management…..35-45%

Security, Confidentiality and Privacy…..35-45%

Considerations for System and Organization Controls (SOC) Engagements…..15-25%

Tax Compliance and Planning for Individuals and Personal Financial Planning…..30-40%

Entity Tax Compliance…..30-40%

Entity Tax Planning…..10-20%

Property Transactions (disposition of assets)…..10-20%

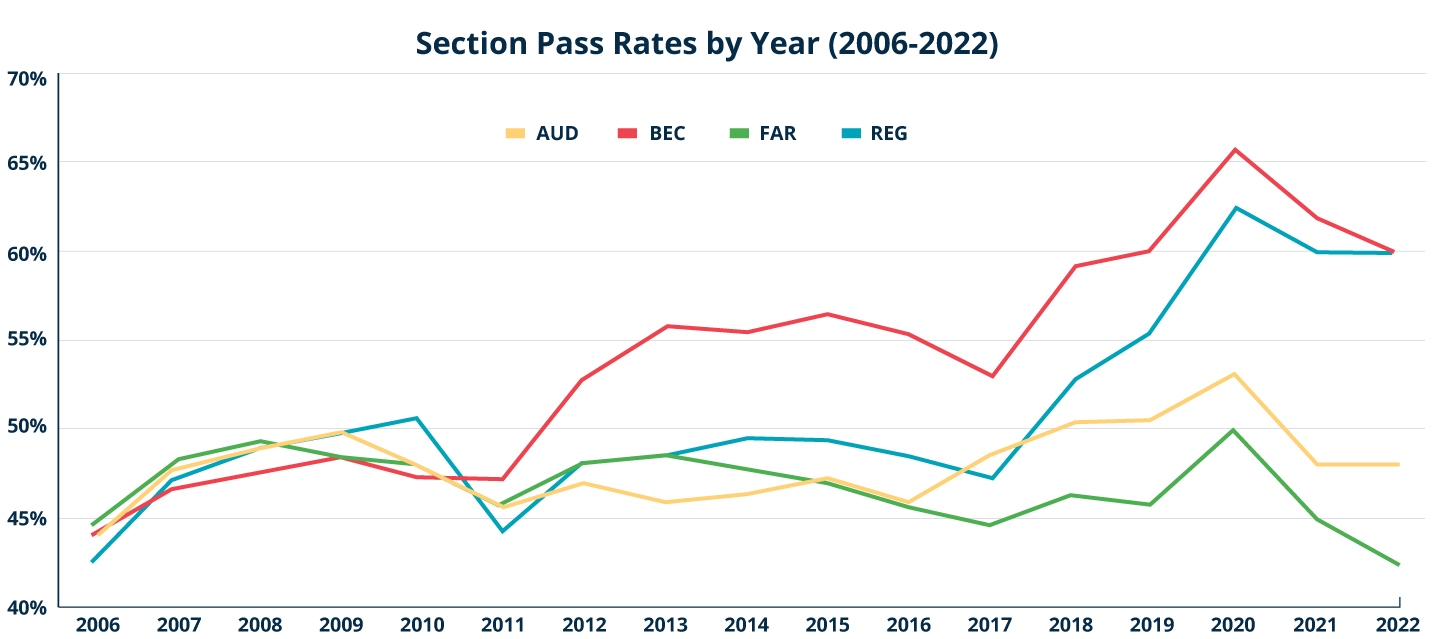

Among the four sections, FAR has a reputation for being the hardest, and it typically has the lowest pass rate. BEC has the highest pass rate and is often thought to be the easiest. AUD and REG tend to be middle of the road.

The CPA Exam is difficult, and the overall pass rates hover around 50%, The AICPA’s goal is for every candidate who passes the exam with the minimum passing score of 75 to reflect positively on the profession. Passing this exam confirms you have the competence to practice in a highly specialized field. To ensure this, the CPA Exam tests candidates at advanced skill levels.

The four skill levels tested in the CPA Exam sections include:

The table below shows how each exam section tests the different skill levels. FAR and BEC test heavily on application, while AUD tests remembering and understanding more than other sections. AUD is also the only section that tests evaluation skills. REG tests your remembering and understanding, application, and analysis skills evenly.

| Skill Levels Assessed | ||||

|---|---|---|---|---|

| Section | Remembering & Understanding |

Application | Analysis | Evaluation |

| AUD | 30-40% | 30-40% | 15-25% | 5-15% |

| FAR | 10-20% | 50-60% | 25-35% | – |

| REG | 25-35% | 35-45% | 25-35% | – |

| BEC | 15-25% | 50-60% | 20-30% | – |

This table shows how the different skill levels will be tested on both the Core and Discipline exams starting January 2024 when the CPA Evolution exam changes go into effect.

| Skill Levels Assessed Starting January 2024 | ||||

|---|---|---|---|---|

| Section | Remembering & Understanding |

Application | Analysis | Evaluation |

| AUD – Core | 30-40% | 30-40% | 15-25% | 5-15% |

| FAR – Core | 5-15% | 45-55% | 35-45% | – |

| REG – Core | 25-35% | 35-45% | 25-35% | – |

| BAR – Discipline | 10-20% | 45-55% | 30-40% | – |

| ISC – Discipline | 55-65% | 20-30% | 10-20% | – |

| TCP – Discipline | 5-15% | 55-65% | 25-35% | – |

To test these skill levels, each four-hour exam section is divided into five testlets. Each testlet contains one type of CPA Exam question.

There are three types of CPA Exam questions:

Different CPA Exam sections contain different amounts of these question types. Written communications only appear on the BEC section of the CPA Exam.

The following table breaks down the number of exam questions by section and testlet.

| Question Types by Sections | ||||||||

|---|---|---|---|---|---|---|---|---|

| Section | Testlet 1 (MCQs) | Testlet 2 (MCQs) | Testlet 3 (TBSs) | Testlet 4 (TBSs) | Testlet 5 (TBSs/ WCs) |

Total MCQs | Total TBSs | Total WCs |

| AUD | 36 | 36 | 2 | 3 | 3 | 72 | 8 | – |

| FAR | 33 | 33 | 2 | 3 | 3 | 66 | 8 | – |

| REG | 38 | 38 | 2 | 3 | 3 | 76 | 8 | – |

| BEC | 31 | 31 | 2 | 2 | 3 WCs | 62 | 4 | 3 |

Once the BEC exam is no longer tested starting January 2024, there will no longer be Written Communication Questions tested on the CPA Exam. The number of MCQs and TBSs will also change for the remaining Core exams.

| Question Types by Section Starting January 2024 | |||||||

|---|---|---|---|---|---|---|---|

| Section | Testlet 1 (MCQs) | Testlet 2 (MCQs) | Testlet 3 (TBSs) | Testlet 4 (TBSs) | Testlet 5 (TBSs) | Total MCQs | Total TBSs |

| AUD – Core | 39 | 39 | 2 | 3 | 2 | 78 | 7 |

| FAR – Core | 25 | 25 | 2 | 3 | 2 | 50 | 7 |

| REG – Core | 36 | 36 | 2 | 3 | 3 | 72 | 8 |

| BAR – Discipline | 25 | 25 | 2 | 3 | 2 | 50 | 7 |

| ISC – Discipline | 41 | 41 | 1 | 3 | 2 | 82 | 6 |

| TCP – Discipline | 34 | 34 | 2 | 3 | 2 | 68 | 7 |

The different types of questions are weighted differently for the exam score. In each section, the two MCQ testlets contribute to half of your exam score. For AUD, FAR, and REG, the remaining three TBS testlets affect the other half of your score, and in BEC, the two TBS testlets and the one WC testlet supply the rest of your score.

| Scoring Weights by Section | |||||||

|---|---|---|---|---|---|---|---|

| Section | MCQ | TBS | WC | ||||

| AUD | 50% | 50% | – | ||||

| FAR | 50% | 50% | – | ||||

| REG | 50% | 50% | – | ||||

| BEC | 50% | 35% | 15% | ||||

Starting in January 2024, the scoring weights will be updated to the following. Only the ISC Discipline exam will have different scoring weights than the other exam sections.

| Scoring Weights by Section Starting January 2024 | |||||||

|---|---|---|---|---|---|---|---|

| Section | MCQ | TBS | |||||

| AUD – Core | 50% | 50% | |||||

| FAR – Core | 50% | 50% | |||||

| REG – Core | 50% | 50% | |||||

| BAR – Discipline | 50% | 50% | |||||

| ISC – Discipline | 60% | 40% | |||||

| TCP – Discipline | 50% | 50% | |||||

Based on decades of experience helping candidates pass, Gleim strongly suggests that students take the exam immediately after graduation (or while in your last semester if permitted by your chosen state board).

Candidates already in the workforce should start studying now, because the sooner you earn your CPA certification, the sooner you can begin enjoying the benefits it brings. Make a CPA Exam study plan and get going!

Short answer: it depends. Determine which section’s content you’re most familiar with and what subject appeals to you most. Think about your recent accounting classes or work experience. Then, read more about each exam section in detail for more specific advice, and play to your strengths!

For an exam this difficult, there isn’t a one-size-fits-all study plan. That’s why Gleim Premium Review Systems come with an interactive study planner and access to Personal Counselors, exam experts who will work with you to develop a personalized plan that will help you pass the CPA Exam on your first attempt.

If you’re here, you’re in the right place. Continue exploring our CPA Resource Center or download our free Exam Guide. Both will equip you with all the information you need to become a CPA.

If you’re already studying, check out our free sample CPA Exam questions or demo. And if you’re in the market for a review course to help you pass the CPA Exam on your first try, take a look at how Gleim CPA Review stacks up against the rest.