Contact Us : 800.874.5346 International: +1 352.375.0772

There are four sections you must pass to complete the CPA Exam, including three core sections: Auditing & Attestation (AUD), Financial Accounting & Reporting (FAR), and Regulation (REG), and a choice of one discipline section: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP)

To earn your CPA you’ll need to pass a total of four sections: the three core exams and your choice of one of three discipline exam sections.

The CPA Exam is designed to measure professional competence in auditing, business law, taxation, and accounting. To accomplish this, each section of the CPA Exam covers different areas of accounting that the AICPA defines in its CPA Exam Blueprints Opens in new window.

Here are the major topics tested on of each of the CPA Exam sections:

Ethics, Professional Responsibilities and General Principles…..15-25%

Assessing Risk and Developing a Planned Response…..25-35%

Performing Further Procedures and Obtaining Evidence…..30-40%

Forming Conclusions and Reporting…..10-20%

Business Analysis…..40-50%

Technical Accounting and Reporting…..35-45%

State and Local Governments…..10-20%

Financial Reporting…..30-40%

Select Balance Sheet Accounts…..30-40%

Select Transactions…..25-35%

Information Systems and Data Management…..35-45%

Security, Confidentiality and Privacy…..35-45%

Considerations for System and Organization Controls (SOC) Engagements…..15-25%

Ethics, Professional Responsibilities and Federal Tax Procedures…..10-20%

Business Law…..15-25%

Federal Taxation of Property Transactions…..5-15%

Federal Taxation of Individuals…..22-32%

Federal Taxation of Entities…..23-33%

Tax Compliance and Planning for Individuals and Personal Financial Planning…..30-40%

Entity Tax Compliance…..30-40%

Entity Tax Planning…..10-20%

Property Transactions (disposition of assets)…..10-20%

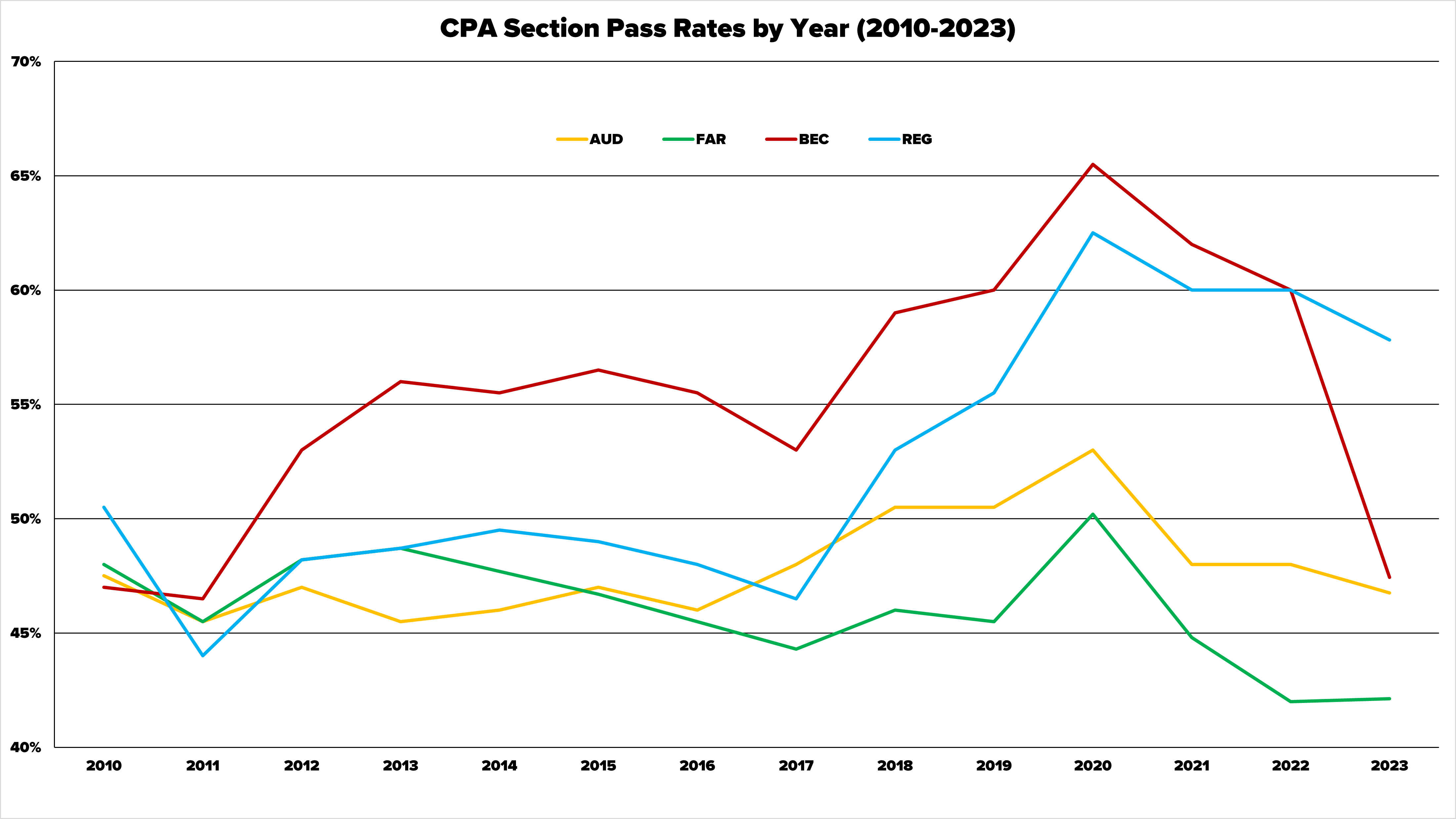

Among the three core sections, FAR has a reputation for being the hardest, and it typically has the lowest pass rate. AUD and REG tend to be middle of the road.

The CPA Exam is difficult, and the overall pass rates hover around 50%, The AICPA’s goal is for every candidate who passes the exam with the minimum passing score of 75 to reflect positively on the profession. Passing this exam confirms you have the competence to practice in a highly specialized field. To ensure this, the CPA Exam tests candidates at advanced skill levels.

The four skill levels tested in the CPA Exam sections include:

The table below shows how each exam section tests the different skill levels. FAR tests heavily on application, while AUD tests remembering and understanding more than other sections. AUD is also the only section that tests evaluation skills. REG tests your remembering and understanding, application, and analysis skills evenly.

| Skill Levels Assessed | ||||

|---|---|---|---|---|

| Section | Remembering & Understanding |

Application | Analysis | Evaluation |

| AUD – Core | 30-40% | 30-40% | 15-25% | 5-15% |

| FAR – Core | 5-15% | 45-55% | 35-45% | – |

| REG – Core | 25-35% | 35-45% | 25-35% | – |

| BAR – Discipline | 10-20% | 45-55% | 30-40% | – |

| ISC – Discipline | 55-65% | 20-30% | 10-20% | – |

| TCP – Discipline | 5-15% | 55-65% | 25-35% | – |

To test these skill levels, each four-hour exam section is divided into five testlets. Each testlet contains one type of CPA Exam question.

There are two types of CPA Exam questions:

Multiple Choice Questions (MCQs)

Every CPA Exam section contains 50% of each question type, with the exception of ISC where there are 60% MCQs and 40% TBSs

The following table breaks down the number of exam questions by section and testlet.

| Question Types by Section | |||||||

|---|---|---|---|---|---|---|---|

| Section | Testlet 1 (MCQs) | Testlet 2 (MCQs) | Testlet 3 (TBSs) | Testlet 4 (TBSs) | Testlet 5 (TBSs) | Total MCQs | Total TBSs |

| AUD – Core | 39 | 39 | 2 | 3 | 2 | 78 | 7 |

| FAR – Core | 25 | 25 | 2 | 3 | 2 | 50 | 7 |

| REG – Core | 36 | 36 | 2 | 3 | 3 | 72 | 8 |

| BAR – Discipline | 25 | 25 | 2 | 3 | 2 | 50 | 7 |

| ISC – Discipline | 41 | 41 | 1 | 3 | 2 | 82 | 6 |

| TCP – Discipline | 34 | 34 | 2 | 3 | 2 | 68 | 7 |

Different types of questions are weighted differently for your exam score. In each section, the two MCQ testlets contribute to half of your exam score. The remaining three TBS testlets affect the other half of your score. With the exception of ISC, where MQCs make up 60% of your exam score, and TBSs make up the other 40%.

| Scoring Weights by Section | |||||||

|---|---|---|---|---|---|---|---|

| Section | MCQ | TBS | |||||

| AUD – Core | 50% | 50% | |||||

| FAR – Core | 50% | 50% | |||||

| REG – Core | 50% | 50% | |||||

| BAR – Discipline | 50% | 50% | |||||

| ISC – Discipline | 60% | 40% | |||||

| TCP – Discipline | 50% | 50% | |||||

Based on decades of experience helping candidates pass, Gleim strongly suggests that students take the exam immediately after graduation (or while in your last semester if permitted by your chosen state board).

Candidates already in the workforce should start studying now, because the sooner you earn your CPA certification, the sooner you can begin enjoying the benefits it brings. Make a CPA Exam study plan and get going!

Short answer: it depends. Determine which section’s content you’re most familiar with and what subject appeals to you most. Think about your recent accounting classes or work experience. Then, read more about each exam section in detail for more specific advice, and play to your strengths!

For an exam this difficult, there isn’t a one-size-fits-all study plan. That’s why Gleim Premium Review Systems come with an interactive study planner and access to Personal Counselors, exam experts who will work with you to develop a personalized plan that will help you pass the CPA Exam on your first attempt.

If you’re here, you’re in the right place. Continue exploring our CPA Resource Center or download our free Exam Guide. Both will equip you with all the information you need to become a CPA.

If you’re already studying, check out our free sample CPA Exam questions or demo. And if you’re in the market for a review course to help you pass the CPA Exam on your first try, take a look at how Gleim CPA Review stacks up against the rest.