Contact Us : 800.874.5346 International: +1 352.375.0772

The Enrolled Agent exam costs over $900 USD before factoring in review materials for the exam. While this isn’t inexpensive, the Enrolled Agent (EA) certification is much more accessible than other accounting certifications, such as the CPA or CMA. This page breaks down each of the EA fees you need to pay and offers a few tips on how you can save money.

| Enrolled Agent Exam Costs | |

|---|---|

| Obtain or Renew PTIN (annual) | $19.75 |

| Scheduling Fee (each part) | $267 |

| Enrollment Fee | $140 |

| EA Premium Review System | ~$799 |

NOTE: All fees are presented in U.S. dollars.

The best way to save money is to make sure you’re prepared for the EA exam before you sit for it. It sounds obvious, but you’ll be paying $267 each time you sit for a part of the EA exam, so the best way to save money is to make sure you pass each part the first time.

The only way to do this is by working with an EA review provider and dedicating enough time to study for the EA exam. Don’t sit for such an expensive exam without knowing what to expect on exam day.

Once you are ready to schedule your EA exam, you will register and pay for each part of the exam separately. Scheduling each part of the EA exam costs $267.

NOTE: If you fail a part of the EA exam, you will need to repay the EA exam fee in order to retake that part of the exam.

EA exam fees are not generally refundable or transferable. Carefully review your appointment confirmation to ensure the exam part, exam location, and the date and time of your test appointment are accurate. If you need to make any corrections, contact Prometric directly.

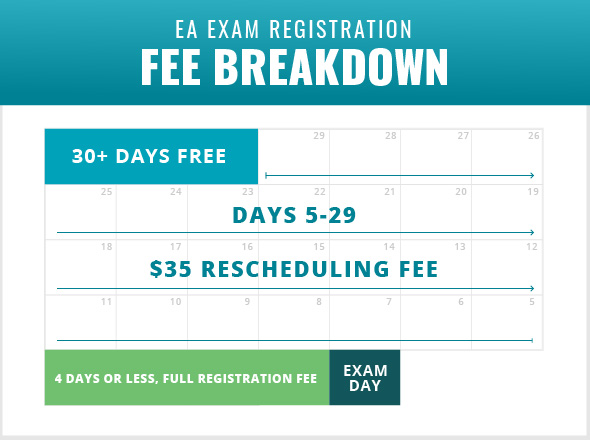

You may reschedule the EA exam without forfeiting your EA exam fee as long as you do so at least 5 days prior to your testing date. But there is a rescheduling fee depending on when exactly you reschedule your exam appointment.

To keep Enrolled Agent exam costs down, make a study plan and stick to it.

After you have passed all three parts of the EA exam, you are required to complete Form 23 and pay a $140 application fee. This application fee is non-refundable and is paid to the United States Treasury Department.

However you decide to study for the Enrolled Agent exam has an associated cost.

Studying from accounting textbooks or the tax code can save you money on materials, but it has massive opportunity costs. You have to spend time figuring out what and how much to study, and you likely will have to purchase books to make sure you get complete content coverage. Get it wrong, and you may have to pay to retake part of the exam.

Working with a time-tested review provider will require you to spend money up front, but it takes the guesswork out of your preparations. Plus, you’ll be following a system that has helped many other candidates pass their exams.

The best way to review is by working with a review provider. The price of a review course can vary, but $600 to $800 is standard for most providers. Some providers will charge a bit more if they offer additional services, so be sure to look beyond the price tag to see what you’re actually getting.

Depending on where you live, you may have to take the exam at a distant testing center. Be sure to consider where you plan to sit for the exam while you’re making your budget. In addition, make sure you register for the EA exam early to secure the most convenient exam date, time, and location.

The EA exam is offered each day at most Prometric Test centers except during March and April. The IRS does not allow the exam to be taken during these months due to tax season. Weekends fill up quickly, so there may also be time off requests to consider if you decide to sit for your exams on weekdays.

In addition to maintaining their PTIN, Enrolled Agents need to complete 72 hours of continuing education (CE) every 3 years with a minimum of 16 hours each year. These courses usually cost between $8 and $12 an hour, but many CE providers offer discounts when you purchase continuing education hours as a part of a package.

To help newly certified Enrolled Agents complete their CE requirements, the Gleim Premium Enrolled Agent Review System now comes with up to 72 CE hours (72 hours for the three-part set and 16 hours for an individual part)! These hours can be used for any tax courses in our CE course catalog.

Earning your Enrolled Agent designation unlocks a lifetime of additional earnings and professional advancement opportunities. The Enrolled Agent is also a logical first step for accountants looking to specialize in tax. Many future CPAs will start with the Enrolled Agent exam to adjust to studying and taking a rigorous exam.

With our years of experience and exceptional results, Gleim EA has perfected the Enrolled Agent prep that can guide you to Enrolled Agent exam success. See why more accountants choose Gleim by signing up for access to our free Enrolled Agent demo today!