Contact Us : 800.874.5346 International: +1 352.375.0772

The best way to become an Enrolled Agent in one year is to pass each part of the EA exam on your first attempt. There are three exam parts you’ll have to study and sit for separately, but it doesn’t have to be as difficult as it sounds. To make becoming an EA manageable, you just need to set small, incremental goals and create a solid study plan.

Start by asking yourself these questions:

Being realistic about your expectations will help you make a plan you can keep. Candidates are more likely to stay on track when they regularly meet the benchmarks they set.

You have three years to pass all three parts of the EA exam, so while you do not technically need to pass all three in the same year, many candidates want to pass before tax season to get more clients. This means appointments to take the exam early in the year can fill up quickly.

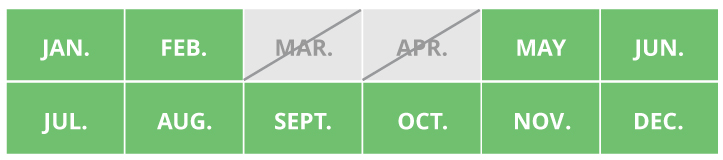

You should decide roughly when you’d like to pass so that you have a framework for building your study plan. The EA exam is offered annually from May 1 through February 28 because downtime is needed to incorporate changes to tax law.

If tax law changes are minor, and they usually are, it doesn’t matter if you decide to take some exam parts in a different year. But if there are large changes, like there were for the Tax Cuts and Jobs Act (TCJA) and the CARES Act, it can be a good idea to get everything done in the same year so you don’t have to account for sweeping changes in part(s) of your exams.

It’s a good idea to set aside regular time for studying, such as an hour before work or during your lunch break. You can try to study for the Enrolled Agent exam “during your free time,” but if you’re like most people, there just isn’t enough extra time when you’re also working or going to school.

The amount of time you’ll actually spend studying depends a lot on how you answered the questions above, but these are the targets you should use when building your plan:

| Average time spent studying per part of the EA exam | |

|---|---|

| Part 1 | 85 hours |

| Part 2 | 125 hours |

| Part 3 | 55 hours |

We got these numbers by examining the course completion times of thousands of our successful candidates. As you can see, EA Part 2 requires a lot more study time than the other exam parts. It covers taxes for businesses, which are more complex than taxes for individuals, so be sure to plan accordingly.

There are two effective ways to create a plan to study for the Enrolled Agent exam:

1. Deadline-based study plans

2. Hours-based study plans

While you’ll likely have both a limited number of hours to study and a deadline, one is almost always more important.

If you have a deadline to become an Enrolled Agent (such as before tax season to increase your income), you need to look at your schedule to determine how many hours per week you will need to study to meet this deadline.

Creating a plan to study for the Enrolled Agent exam based on hourly restrictions is very similar to creating one based on a hard deadline.

To finish your study plan, follow steps 4 through 7 from the deadline-based approach.

NOTE: Remember, you can study for the Enrolled Agent exam beyond your planned hours. Studying more can help get you ahead of your schedule. This is especially helpful for unexpected life events that might interrupt studying later in your study plan.

Because the Enrolled Agent exam tests the previous year’s tax law, there is no better time to start studying than right after tax season. All of that year’s tax laws are fresh in your mind, which will just help you more while studying and answering questions. Below we cover a sample plan to study for the Enrolled Agent exam using an average of 10 hours per week. Your exact plan will likely differ based on your goals and commitments.

| EA Part 1 | |

|---|---|

| Start Date | April 22 |

| Final Review | June 24 |

| Exam Date | July 1 |

Passing EA Part 1 before July 4th gives you a hard date to complete your exam by and something to look forward to once you’re done! After passing Part 1, take a few days to relax and then move on to Part 2.

| EA Part 2 | |

|---|---|

| Start Date | July 5 |

| Final Review | September 27 |

| Exam Date | October 4 |

If you have tax returns to handle in October for the extension filing season, it might be a good idea to sit for EA Part 2 before mid-October. If you can put more than 10 hours a week into your studies, you can be done much sooner!

| EA Part 3 | |

|---|---|

| Start Date | October 17 |

| Final Review | November 28 |

| Exam Date | December 5 |

We started EA Part 3 after the October 15th deadline, but if you can, starting sooner will be to your benefit! Even if you can’t, this schedule still has you passing your final section before the end of December, which gives you plenty of time to ready yourself for the following tax season (and to advertise your new designation)!

After setting up your study plan, you need to study! Check out our EA study tips to help you study for the Enrolled Agent exam. You will then register for the Enrolled Agent exam with Prometric. After passing all three exams, you will need to fill out Form 23 with the IRS to Apply for Enrollment Opens in new window.